Tiger 21, a peer membership organization for high-net-worth wealth creators and preservers, is roaring into Tel Aviv.

Tiger 21 founder Michael Sonnenfeldt said he decided to expand into Israel because of his great appreciation of Israeli high-tech and the strong local business community.

“Anyone involved with Israel could not help understand the political tensions going on there,” the American philanthropist admitted. “However, businesspeople tend to be non-ideological and very pragmatic about helping each other.”

The group will be chaired by serial intrapreneur and entrepreneur Beny Rubinstein.

Tiger 21, founded in 1999, is already running more than 100 groups of 12 to 15 members in 46 cities around the globe. Group members are current and former entrepreneurs, investors and top executives with assets of at least $20 million but generally under $1 billion. Collectively, the organization’s 1,300 members manage $150 billion.

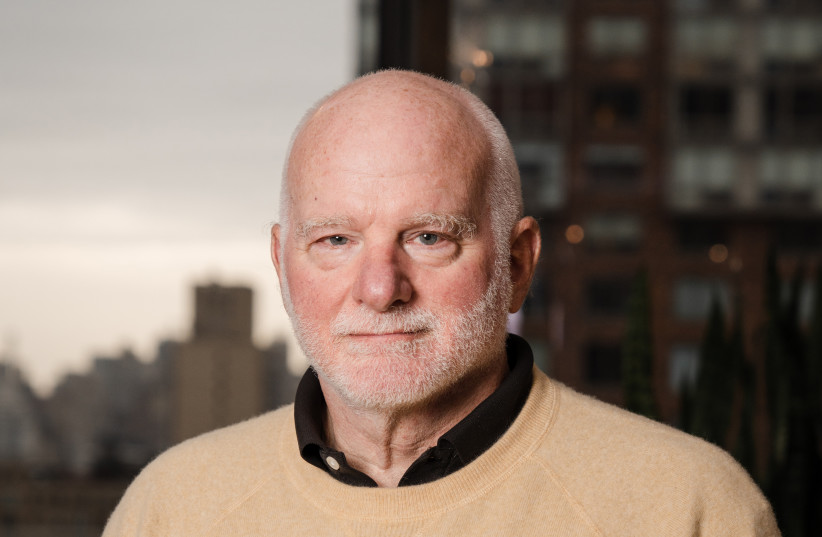

Michael Sonnenfeldt (credit: Tiger 21)

Michael Sonnenfeldt (credit: Tiger 21)“Our members are generally people who built extraordinary businesses and either have created enough wealth to manage a significant investment portfolio or who have sold their businesses and now, for the first time, have gone from wealth creators to wealth preservers,” Sonnenfeldt said.

“Although those titles may seem similar, they are totally different. Entrepreneurs might have hundreds of people working for them; they might be leaders or managers who need to inspire people. Their connection to their companies is very emotional. But you must be very rational and dispassionate when you are a wealth preserver. Very often, you are alone."

“People who are the best entrepreneurs are often quite mediocre investors because the skill sets are very different,” he continued. “You don’t realize that until you find yourself managing wealth, and then you can make some rookie mistakes that can be costly.”

Entrepreneurial exclusivity

The core of Tiger 21 is monthly group meetings where these individuals, all superstars in their own right, can share confidentiality about their portfolios. It is called peer-to-peer learning, and “we think that when you are dealing with people of this success level, it is one of the best models out there.”

Once a year, all the members get together. And there is a digital communications network.

Most members are first-generation wealth creators, meaning they did not get their money via inheritance. The groups include a lot of immigrants, as well.

Over time, like-minded members have also formed side groups, like the climate investment network that Sonnenfeldt hosts with 12 members who each, on average, have a net worth of $100 million that they are investing in climate-related businesses.

“This is my passion, and we get to share many ideas in the network,” Sonnenfeldt added.

In addition, they become friends and help each other.

He shared how, recently, a member’s child was in a car accident in a foreign city and called Tiger 21 members in that city, and they told the member which hospital and doctors to use. In another case, a member had a medical emergency in Florida. He posted on the Tiger 21 private network, and a member sent his private plane to get him home to Texas.

Sonnefeldt recalled how Tiger 21 started with only six members and most people around 60. Today, the average is closer to 50; many members are in their 30s and 40.

“This will be particularly true in Israel,” he said, “where young people have startups and create significant wealth in a five- to 10-year period instead of over 30 or 40 years.”

He said a country the size of Israel could eventually support three to five Tiger groups.